UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON,Washington D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant[X] [X]

Filed by a Party other than the Registrant[ ]

Check the appropriate box:

| [X] | Preliminary Proxy Statement |

| [ ] | Confidential, for |

| [ ] | Definitive Proxy Statement |

| [ ] | Definitive Additional Materials |

| [ ] | Soliciting Material Pursuant to |

DOCUMENT SECURITY SYSTEMS, INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [X] | No fee required. |

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

| (1) | Title of each class of securities to which transaction | |

| (2) | Aggregate number of securities to which transaction applies: | |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 | |

| (4) | Proposed maximum aggregate value of transaction: | |

| (5) | Total fee paid: | |

| [ ] | Fee paid previously with preliminary materials. | |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule | |

| (1) | Amount Previously Paid: | |

| (2) | Form, Schedule or Registration Statement No.: | |

| (3) | Filing Party: | |

| (4) | Date Filed: | |

PRELIMINARY PROXY MATERIALS – SUBJECT TO COMPLETION

DOCUMENT SECURITY SYSTEMS, INC.

200 CANAL VIEW BOULEVARD, SUITE 300104

ROCHESTER, NEW YORK 14623

NOTICE OF ANNUALSPECIAL MEETING OF STOCKHOLDERS

To be held July [27], 2020

The Annual Meeting

To our Stockholders:

A special meeting of Stockholdersstockholders (the “Annual“Special Meeting”) of Document Security Systems, Inc., a New York corporation (the “Company”, or “DSS” or “us” or “we”, “us” or “our”) will be held on Tuesday, June 28, 2016, at 11:00 a.m. (Eastern Standard Time)_____________on Monday, July 27, 2020 at 200 Canal View Boulevard, Suite 300, Rochester, New York 14623________a.m. local time for the purposes of:following purpose:

To ratify the approval by our Board of Directors of an ; and | ||

In this proxy statement, the term “Company” or “DSS” or “us” or “we” or “our” means Document Security Systems, Inc. and its direct and indirect subsidiaries, unless the context otherwise provides. The foregoing items ofaccompanying proxy statement sets forth additional information regarding the Special Meeting, and provides you with detailed information regarding the business are more fully describedto be considered at the Special Meeting. We encourage you to read the proxy statement carefully and in the Proxy Statement accompanying this notice.its entirety.

The Board of Directors has fixed the close of business on Friday, April 29, 2016June 18, 2020 has been fixed as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and atmeeting or any adjournment or postponement thereof. Stockholders holding a majority of the votes cast at the Special Meeting must vote in favor of Proposal 1, Proposal 2 and Proposal 3 to be approved by stockholders.

This year, we are again implementingYour vote is very important, regardless of the “Noticenumber of shares you own. Whether or not you expect to attend the Special Meeting in person, please mark, sign, date and Access” method approved byreturn the Securities and Exchange Commission that allows companies to provideenclosed proxy materials to stockholders viaas promptly as possible in the Internet. The Internet will be used as our primary means of furnishingenclosed postage-prepaid envelope. If you attend the meeting you may vote in person, even if you returned a proxy. These proxy materials to our stockholders. Consequently, stockholders will not receive paper copies of our proxy materials. We will instead send stockholders a notice with instructions for accessing the proxy materials and voting via the Internet. The notice also provides information on how stockholders may obtain paper copies of our proxy materials if they so choose. This makes the proxy distribution process more efficient and less costly.

A Notice of Internet Availability of Proxy Materials, which contains specific instructions on how to access those materials via the Internet and vote online, as well as instructions on how to request paper copies, will be mailed to our stockholders on or about May 16, 2016. The Company’s Annual Report and the Proxy Statement, along with any amendments________ to the foregoing materials that are required to be furnished to stockholders will be available at https://materials.proxyvote.com/25614T.of record on the Record Date.

By Order of the Board of Directors of Document Security Systems, Inc.

| /s/ Heng Fai Ambrose Chan | ||

| Heng Fai Ambrose Chan |  | |

| Chairman of the Board |

WHETHER OR NOT YOU PLAN ON ATTENDING THE ANNUALSPECIAL MEETING IN PERSON, PLEASE VOTE USING THE PROXY CARD AS PROMPTLY

AS POSSIBLE TO ENSURE THAT YOUR VOTE IS COUNTED.THE DSS BOARD OF DIRECTORS HAS DETERMINED AND BELIEVES THAT EACH OF THE PROPOSALS OUTLINED ABOVE IS ADVISABLE TO, AND IN THE BEST INTERESTS OF, DSS AND ITS STOCKHOLDERS AND HAS APPROVED EACH SUCH PROPOSAL. THE DSS BOARD OF DIRECTORS RECOMMENDS THAT DSS STOCKHOLDERS VOTE “FOR” EACH SUCH PROPOSAL.

| 2 |

DOCUMENT SECURITY SYSTEMS, INC.

200 CANAL VIEW BOULEVARD, SUITE 300104

ROCHESTER, NEW YORK 14623

PROXY STATEMENT FOR THE COMPANY’S

ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON JUNE 28, 2016

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS

Why am I receiving these proxy materials?

The proxy materials describe the proposals on which our Board of Directors would like you, as a stockholder, to vote on at the Annual Meeting. The materials provide you with information on these proposals so that you can make an informed decision. We intend to mail a Notice of Internet Availability of Proxy Materials (the “Notice”) to all stockholders of record entitled to vote at the Annual Meeting.

Who can vote at the Annual Meeting of Stockholders?

Stockholders who owned shares of common stock of the Company, par value $0.02 per share (the “Common Stock”), as of April 29, 2016, the Record Date, may attend and vote at the Annual Meeting. Each share is entitled to one vote. There were 51,881,948 shares of Common Stock outstanding as of the Record Date. All shares of Common Stock shall vote together as a single class.

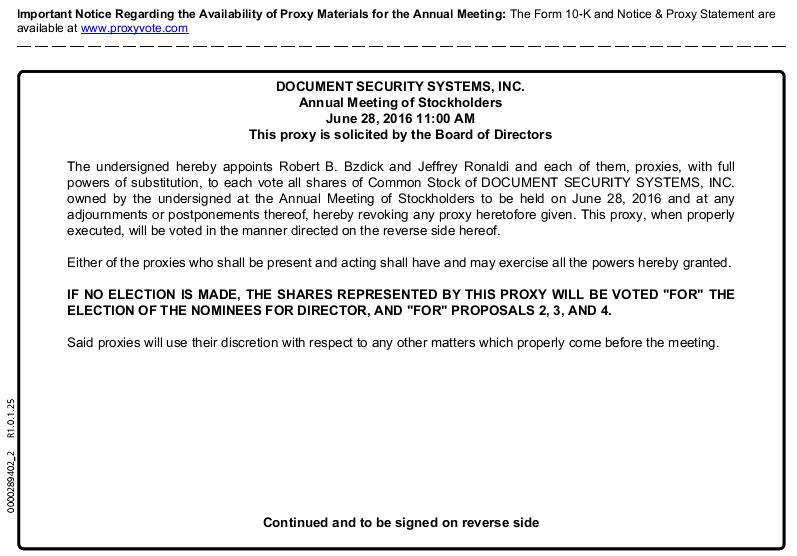

What is the proxy card?

The proxy card enables you to appoint the persons named therein as your representative to vote your shares at the Annual Meeting, and to provide specific instructions as to how you wish your shares to be voted. By completing and returning the proxy card, you are authorizing these persons to vote your shares at the Annual Meeting in accordance with your instructions on the proxy card. By providing specific voting instructions for each proposal identified on the proxy card, your shares will be voted in accordance with your wishes whether or not you attend the Annual Meeting. Even if you plan to attend the Annual Meeting, we suggest that you complete and return your proxy card before the Annual Meeting date just in case your plans change. If a routine proposal comes up for vote at the Annual Meeting that is not on the proxy card, your appointed representative will vote your shares, under your proxy, according to their best judgment.

What am I voting on?

You are being asked to vote on the election of the Company’s Board of Directors, on the ratification of the Company’s independent registered public accountants for the fiscal year ending December 31, 2016, for approval of executive compensation as disclosed in this Proxy Statement of the Company’s executive officers who are named in this Proxy Statement’s Summary Compensation Table, and for approval of an amendment to the Company’s certificate of incorporation to effect a 1-for-4 reverse stock split. We may also transact any other business that properly comes before the Annual Meeting.

How does the Board of Directors recommend that I vote?

Our Board of Directors unanimously recommends that the stockholders vote “For” the nominees for director, “For” the ratification of the Company’s independent registered public accountants for the fiscal year ending December 31, 2016, “For” approval of the executive compensation disclosed in this Proxy Statement of the Company’s executive officers who are named in this Proxy Statement’s Summary Compensation Table, and “For” approval of an amendment to the Company’s certificate of incorporation to effect a 1-for-4 reverse stock split.

What is the difference between holding shares as a stockholder of record and holding shares as a beneficial owner?

Most of our stockholders hold their shares in an account at a brokerage firm, bank, broker dealer or other nominee holder, rather than holding share certificates in their own name. As summarized below, there are some distinctions between shares held of record and those owned beneficially.

Registered Stockholders (Stockholders of Record)

If on the Record Date, your shares were registered directly in your name with our transfer agent, American Stock Transfer and Trust Company, LLC, you are a stockholder of record who may vote at the Annual Meeting. As the stockholder of record, you have the right to direct the voting of your shares via the internet or telephone or, if you request, by returning a proxy card to us. You may also vote in person at the Annual Meeting. Whether or not you plan to attend the Annual Meeting, please vote via the internet or telephone, or if you request, complete, date and sign a proxy card and provide specific voting instructions to ensure that your shares will be voted at the Annual Meeting.

Beneficial Owner

If on the Record Date, your shares were held in an account at a brokerage firm, bank, broker-dealer or other similar organization, you are considered the beneficial owner of shares held “in street name”, and the Notice is being forwarded to you by that organization. The organization holding your account is considered the shareholder of record for purposes of voting at the Annual Meeting. As the beneficial owner, you have the right to instruct your nominee holder on how to vote your shares and to attend the Annual Meeting. However, since you are not the stockholder of record, you may not vote these shares in person at the Annual Meeting unless you receive a valid proxy from your brokerage firm, bank, broker dealer or other nominee holder. To obtain a valid proxy, you must make a special request of your brokerage firm, bank, broker dealer or other nominee holder. If you do not make this request, you can still vote by following the voting instructions contained in the Notice; however, you will not be able to vote in person at the Annual Meeting.

How do I Vote?

Stockholders of record (also called registered stockholders) may vote by any of the following methods:

A. By mail: if you request or receive proxy materials by mail, you may vote by completing the proxy card with your voting instructions and returning it in the postage-paid envelope provided.

If we receive your proxy card prior to the Annual Meeting date and you have marked your voting instructions on the proxy card, your shares will be voted:

B. By Internet: read the proxy materials and follow the instructions provided in the Notice.

C. By toll-free telephone: read the proxy materials and call the toll free number provided for in the proxy voting instructions.

D. In person at the Annual Meeting.

If your shares are held in the name of a broker, bank, broker dealer or other nominee holder of record, you may vote by any of the following methods:

A. By Mail: If you request or receive printed copies of the proxy materials by mail, you may vote by completing the proxy card with your voting instructions and returning it to your broker, bank, broker dealer or other nominee holder of record prior to the Annual Meeting.

B. By Internet: You may vote via the Internet by following the instructions provided in the Notice mailed to you by your nominee holder.

C. By toll-free telephone: You may vote by calling the toll free telephone number found in the proxy voting instructions.

D. In Person: If you are a beneficial owner of shares held in street name and you wish to vote in person at the Annual Meeting, you must obtain a valid proxy from the nominee organization that holds your shares.

Why did I receive a Notice in the mail regarding the Internet availability of proxy materials instead of a full set of proxy materials?

Pursuant to rules adopted by the Securities and Exchange Commission, the Company has elected to provide access to its proxy materials over the Internet. Accordingly, the Company is sending such Notice to the Company’s stockholders of record and beneficial owners. All stockholders will have the ability to access the proxy materials on the website referred to in the Notice or request to receive a printed set of the proxy materials. Instructions on how to access the proxy materials over the Internet or to request a printed copy may be found in the Notice. In addition, stockholders may request to receive proxy materials in printed form by mail or electronically by email on an ongoing basis. The Company encourages you to take advantage of the availability of the proxy materials on the Internet.

What does it mean if I receive more than one proxy card?

You may have multiple accounts at the transfer agent and/or with brokerage firms. Please sign and return all proxy cards, and provide your voting instructions, to ensure that all of your shares are voted for each of the proposals.

What if I change my mind after I return my proxy?

You may revoke your proxy and change your vote at any time before the polls close at the Annual Meeting. You may do this by:

Please note, however, that if your shares are held of record by a brokerage firm, bank, broker dealer or other nominee, you must instruct your broker, bank, broker dealer or other nominee that you wish to change your vote by following the procedures on the voting form provided to you by the broker, bank, broker dealer or other nominee. If your shares are held in street name, and you wish to attend the Annual Meeting and vote at the Annual Meeting, you must bring to the Annual Meeting a legal proxy from the broker, bank, broker dealer or other nominee holding your shares, confirming your beneficial ownership of the shares and giving you the right to vote your shares.

How are votes counted?

Consistent with state law and our bylaws, the presence, in person or by proxy, of at least a majority of the shares entitled to vote at the meeting will constitute a quorum for purposes of voting on a particular matter at the meeting. Once a share is represented for any purpose at the meeting, it is deemed present for quorum purposes for the remainder of the meeting and any adjournment thereof unless a new record date is set for the adjournment. Shares held of record by stockholders or their nominees who do not vote by proxy or attend the meeting in person will not be considered present or represented and will not be counted in determining the presence of a quorum. Signed proxies that withhold authority or reflect abstentions and “broker non-votes” will be counted for purposes of determining whether a quorum is present. “Broker non-votes” are proxies received from brokerage firms or other nominees holding shares on behalf of their clients who have not been given specific voting instructions from their clients with respect to matters being voted on. Broker non-votes will be counted for purposes of establishing a quorum to conduct business at the meeting, but not for determining the number of shares voted FOR, AGAINST, ABSTAINING or WITHHELD FROM with respect to any matters.

Assuming the presence of a quorum at the meeting:

We strongly encourage you to provide instructions to your bank, brokerage firm, or other nominee by voting your proxy. This action ensures that your shares will be voted in accordance with your wishes at the meeting.

Is my vote kept confidential?

Proxies, ballots and voting tabulations identifying stockholders are kept confidential and will not be disclosed except as may be necessary to meet legal requirements.

Where do I find the voting results of the Annual Meeting?

We plan to announce preliminary voting results at the Annual Meeting. We will also file a Current Report on Form 8-K with the Securities and Exchange Commission within four business days of the Annual Meeting disclosing the final voting results.

Who can help answer my questions?

You can contact our corporate headquarters, at (585) 325-3610, or send a letter to: Investor Relations, Document Security Systems, Inc., 200 Canal View Boulevard, Suite 300, Rochester, New York 14623, with any questions about proposals described in this Proxy Statement or how to execute your vote.

DOCUMENT SECURITY SYSTEMS, INC.

200 CANAL VIEW BOULEVARD, SUITE 300

ROCHESTER, NEW YORK 14623

PROXY STATEMENT

SOLICITATIONSPECIAL MEETING OF PROXIESSTOCKHOLDERS

This Proxy Statement is furnishedWe are furnishing this proxy statement (the “Proxy Statement”) to the holders of our Common Stock, par value $0.02 per share (the “Common Stock”), in connection with the solicitation of proxies byon behalf of the Board of Directors (the “Board”) of Document Security Systems, Inc. (the(together with its consolidated subsidiaries (unless the context otherwise requires), referred to herein as “Document Security Systems,” “DSS,” “we,” “us,” “our” or the “Company”), for use at the Annual Meetinga special meeting of Stockholders of the Companystockholders (the “Annual“Special Meeting”) to be held at 200 Canal View Boulevard, Suite 300, Rochester, New York 14623[_____________] on Tuesday, June 28, 2016,Monday, July 27, 2020 at 11:00 a.m. (Eastern Standard Time)________a.m. local time, and at any adjournments or postponementsadjournment thereof. Solicitation

The Special Meeting of proxies maystockholders will be made by directors, officers,held for the following purposes:

| 1. | To approve the issuance of shares of DSS Common Stock and Series A Preferred Stock (in connection with the acquisition of Impact BioMedical Inc., a Nevada corporation (“Impact BioMedical”), pursuant to the Share Exchange Agreement, a copy of which is attached asAppendix A (the “Share Exchange Agreement”); | |

| 2. | To authorize an adjournment of the Special Meeting, if necessary, if a quorum is present, to solicit additional proxies if there are not sufficient votes in favor of Proposal 1; and | |

| 3. | To ratify the approval by our Board of Directors of an amendment to our bylaws to allow for participation in stockholder meetings by means of virtual meeting technology (the “Virtual Meeting Proposal”), as more fully described in Proposal 3; |

The acquisition outlined in Proposal 1 is structured so that Impact BioMedical will become a solicitor or other employeeswholly-owned subsidiary of DSS BioHealth Security, Inc., a Delaware corporation and wholly owned subsidiary of the Company. Compensation may be paid to a proxy solicitor should the Company determine that such services are required. This solicitation of proxies is being made by the Company which will bear all costs associated with the mailing(“DBHS”) in exchange for DSS Common Stock and Series A Preferred Stock (the “Share Exchange”). As of the date of this proxy materials andstatement, the solicitationBoard is not aware of proxies. Whether or not you expect to attendany other matters that will come before the AnnualSpecial Meeting. However, if any other matters properly come before the Special Meeting, in person, and if you request and receive proxy materials by mail, please return your executed proxy card in the enclosed envelope and the shares represented therebypersons named as proxies will be votedvote on them in accordance with your instructions. The Notice of Internet Availability of Proxy Materials (the “Notice”) will be mailed to all stockholders on or about May 16, 2016. The proxy voting instructions accompanying the Notice describe the process for voting your shares via the Internet or by telephone. For stockholders who request mailings of the proxy materials, we will begin mailing the proxy materials to stockholders on or about May 19, 2016.their best judgment.

REVOCABILITY OF PROXY

Any stockholder executing a proxy that is solicited has the power to revoke it prior to the voting of the proxy. Revocation may be made by i) attending the AnnualSpecial Meeting and voting the shares of stock in person, or byii) delivering to the Secretary of the Company at the principal office of the Company prior to the AnnualSpecial Meeting a written notice of revocation or a later-dated, properly executed proxy.proxy, iii) signing another proxy card with a later date and returning it before the polls close at the Special Meeting, or iv) voting again via the internet or by toll free telephone by following the instructions on the proxy card.

RECORD DATEGENERAL INFORMATION ABOUT VOTING

StockholdersRecord Date

Only the holders of record of our Common Stock at the close of business on April 29, 2016the record date, _____________, 2020 (the “Record Date”) will be, are entitled to notice of and to vote at the Annual Meeting.meeting. On the Record Date, there were _____________ shares of our Common Stock outstanding. Stockholders are entitled to one vote for each share of Common Stock held on the Record Date.

| 3 |

ACTION TO BE TAKEN UNDER PROXYVoting

InWhen a proxy is properly executed and returned (and not subsequently properly revoked), the case ofshares it represents will be voted in accordance with the Company receiving a signed proxy (“Proxy”) from a registered stockholder containing voting instructions “FOR” the election of each of the nominated directors, and “FOR” Proposals 2, 3 and 4, the persons named in the Proxy (Robert Bzdick, Secretary of the Company, and Jeffrey Ronaldi, Chief Executive Officer of the Company),directions indicated thereon, or, either one of them who acts (the “Proxy Representative”),if no direction is indicated thereon, it will vote:be voted:

| (1) | FOR | |

| (2) | FOR | |

| (3) | FOR | |

Votes Required for Approval

The affirmative vote of a majority of the votes cast is required for approval of Proposals 1, 2 and 3.

Abstentions and Broker Non-Votes

Broker Non-Votes: If you hold your shares through a bank, broker or other nominee and do not provide voting instructions to that entity, it may vote your shares only on “routine” matters. For “non-routine” matters, the beneficial owner of such shares is required to provide instructions to the bank, broker or other nominee in order for them to be entitled to vote the shares held for the beneficial owner. Proposal 1 (approval of the Share Exchange) will be treated as a non-routine matter. The approval of Proposal 2 (Adjournment Proposal) and Proposal 3 (the Virtual Meeting Proposal) will be treated as routine matters. If you hold your shares in street name and you do not instruct your bank, broker or other nominee how to vote for the approval of the Share Exchange, no votes will be cast on your behalf with respect to this proposal.

If you hold your shares in street name, it is critical that you cast your vote if you want it to count on all matters to be decided at the Special Meeting.

Broker non-votes are counted for purposes of determining whether or not a quorum exists for the transaction of business at the Special Meeting. Broker non-votes, as well as abstentions from voting, will not, however, be treated as votes cast and, therefore, will have no effect on the outcome of Proposal 1 (approval of the Share Exchange), Proposal 2 (approval of the Adjournment Proposal) or Proposal 3 (approval of the Virtual Meeting Proposal). As stated above, Proposals 2 and 3 will be treated as routine matters, which means that brokers will be able to use their discretion to vote on behalf of the beneficial owner absent instructions from such owners. Therefore, no broker non-votes are expected to exist with respect to these proposals.

***

You can contact our corporate headquarters, at (585) 325-3610, or send a letter to: Investor Relations, Document Security Systems, Inc., 200 Canal View Boulevard, Suite 104, Rochester, New York 14623, with any questions about proposals described in this Proxy Statement or how to execute your vote.

| 4 |

PROPOSAL 1— APPROVAL OF THE ISSUANCE OF SHARES OF DSS COMMON STOCK AND

SERIES A PREFERRED STOCK IN CONNECTION WITH THE ACQUISITION OF IMPACT

BIOMEDICAL, INC.

Structure of the Acquisition

On April 27, 2020, the Board of Directors of Company (the “Board”) approved and the Company entered into the Share Exchange Agreement with DSS BioHealth Security, Inc., a Nevada corporation and wholly owned subsidiary of the Company (“DBHS”), Singapore eDevelopment Limited, a Singapore corporation (“Singapore eDevelopment”) that is listed on the Singapore Exchange, and Global BioMedical Pte Ltd, a Singapore corporation and wholly owned subsidiary of Singapore eDevelopment (“Global BioMedical”). Pursuant to the Share Exchange Agreement and upon an affirmative vote for this Proposal, DBHS will acquire of all of the outstanding capital stock (the “Impact Shares”) of Impact BioMedical Inc., a Nevada corporation and wholly owned subsidiary of Global BioMedical (“Impact”), in exchange for DSS Common Stock and Series A Preferred Stock, with Impact becoming a direct wholly owned subsidiary of the DBHS (the “Share Exchange”).

The aggregate consideration for the Impact Shares will be the following to be issued to Global BioMedical by DSS: (i) 483,334 newly issued shares of Common Stock of DSS, nominally valued at $3,132,000, or $6.48 per share; and (ii) 46,868 newly issued shares of a new series of perpetual Series A Convertible Preferred Stock of DSS (“Series A Preferred Stock”) with a stated value of $46,868,000, or $1,000 per share, for a total consideration valued at $50 million. The Series A Preferred Stock will have such terms, rights, obligations and preferences of the Series A Preferred Stock set forth in the Designation of Series A Convertible Preferred Stock of the Company (the “Certificate of Designations”), to be filed with the Secretary of State of the State of New York prior to the closing of the Share Exchange. The terms of the Share Exchange Agreement and the Share Exchange were previously reported in the Form 8-K filed by the Company on March 13, 2020.

As previously reported, on May 7, 2020, following the date of the Share Exchange Agreement we effected a 30-1 reverse stock split. As a result, the number of Common Stock shares to be issued by DSS pursuant to the Share Exchange have been appropriately adjusted.

Designation of the Series A Preferred Stock

Under the Certificate of Designations, each share of Series A Preferred Stock will be convertible into shares of Common Stock of DSS, subject to a 19.9% beneficial ownership conversion limitation (“Beneficial Ownership Limitation”) based on the total issued outstanding shares of Common Stock of DSS beneficially owned by Global BioMedical. Holders of the Series A Preferred Stock will have no voting rights, except as required by applicable law or regulation, and no dividends will accrue or be payable on the Series A Preferred Stock. The holders of Series A Preferred Stock will be entitled to a liquidation preference at a liquidation value of $1,000 per share, and the Company will have the right to redeem all or any portion of the then outstanding shares of Series A Preferred Stock, pro rata among all holders, at a redemption price per share equal to such liquidation value per share.

In addition, under the Certificate of Designation, the Company will have the right to convert all or any portion of the then outstanding shares of Series A Preferred Stock, pro rata among all holders, into an aggregate number of shares of Common Stock as is determined by (i) multiplying the number of shares to be converted by the liquidation value per share, and then (ii) dividing the result by the applicable conversion price then in effect.

Company Overview

Document Security Systems, Inc. is a global company involved in the development and delivery of better products and technology to individuals and industry. We operate nine business lines through subsidiaries located around the globe.

| 5 |

Of the nine business lines, four have historically been the core business lines of the Company:

| 1. | Premier Packaging Corporation (DSS Packaging and Printing Group) operates in the | |

| These two companies develop, manufacture and sell paper and plastic products designed to protect valuable information from counterfeit, unauthorized scanning, copying, and digital imaging, and to provide intelligent, interactive, augmented packaging for the consumer. | ||

| 3. | DSS Digital Inc. (DSS Digital Group) researches, develops, markets and sells the Company’s digital products worldwide; their | |

| 4. | DSS Technology Management, Inc. (DSS Technology Management) manages, licenses and acquires intellectual property, or IP, assets for the purpose of monetizing these assets through a variety of value-enhancing initiatives, including, but not limited to, investments in the development and commercialization of patented technologies, licensing, strategic partnerships and commercial litigation. | |

In addition to these four core business lines, in 2019 and early 2020 we established five new wholly owned subsidiaries:

| 1. | DSS Blockchain Security, Inc., intends to specialize in the development of blockchain security technologies for tracking and tracing solutions for supply chain logistics and cyber securities across global markets. | |

| 2. | Decentralized Sharing Systems, Inc., seeks to provide services to assist companies in the new business model of the peer-to-peer decentralized sharing marketplaces and direct marketing. Direct marketing or network marketing is designed to sell products or services directly to the public through independent distributors, rather than selling through the traditional retail market. Of the newly established business lines, Decentralized is the first to establish a material gross revenue stream and we anticipate revenue growth. As a result, we have added this business line to our segment reporting. | |

| 3. | DSS Securities, Inc., has been established to develop or to acquire assets in the securities trading or management arena, and to pursue two parallel streams of digital asset exchanges in multiple jurisdictions: (i) securitized token exchanges, focusing on digitized assets from different vertical industries; and (ii) utilities token exchanges, focusing on “blue-chip” utility tokens from solid businesses. | |

| 4. | DSS BioHealth Security, Inc., will seek to invest in or to acquire companies related to the biohealth and biomedical field, including businesses focused on the | |

| 5. | DSS Secure Living, Inc., intends to develop top of the line advanced technology for energy efficiency, high quality of life living environments and home security for everyone, for new construction and renovations of residential single and multifamily living facilities. | |

Aside from Decentralized Sharing Systems, Inc. the activities in these newly created subsidiaries have been minimal or | ||

| 6 |

Background of the Share Exchange

In November 2019, we announced the Company’s new strategic business plan, which focuses on strengthening our organization, investing in our core lines of business, improving top line revenues and net margins, controlling costs and creating new long-term recurring revenue streams. One of the core elements of the strategic business plan includes implementing business diversification initiatives as described in more detail below.

Implementing Business Diversification Initiatives – We plan to both internally develop and to acquire profitable new businesses, which will in some cases be complimentary to our core businesses and addressable markets. In other instances, we intend to explore opportunities for expansion into new business lines in which we believe we can successfully compete, which are scalable, and which generate sustainable reoccurring revenue. Management has already taken steps toward this diversification by performing initial research and cost analysis into specific new business lines, and in 2019 we formed the five new subsidiaries as described in more detail above, in an effort to grow and expand our technologies and market reach, including DSS BioHealth Security, Inc., referred to in this proxy statement as DBHS.

DSS BioHealth Security, Inc. This business will be principally involved in the bio-medical sector, including investing in companies that hold bio-medical intellectual property and/or have, or are securing, strategic alliances, partnerships and distribution rights for bio-medical and security products, technologies or enterprises. This new division will focus on open-air defense initiatives that seek to curb transmission of airborne infectious diseases such as tuberculosis and influenza, among others, in open areas.

Consistent with this growth initiative, on March 12, 2020, the Company announced that the Board approved and Company had entered into a binding term sheet (the “Term Sheet”) to acquire Impact BioMedical, a company engaged in the development and marketing of biohealth security technologies, pursuant to which Impact BioMedical would become a wholly-owned subsidiary of DSS BioHealth Security, Inc. Pursuant to the Term Sheet, the proposed share exchange transaction was capped at a purchase price capped at $50 million, subject to completion of due diligence and an independent valuation.

On April 27, 2020, prior to the execution of the Share Exchange Agreement, Impact BioMedical’s ownership of a suite of antiviral and medical technologies was valued at $382 million through a required independent valuation that was completed by Destum Partners. Because the valuation was higher than the previously agreed value, the purchase price to be paid be the Company was capped at a value of $50 million.

On April 27, 2020, the Company issued a press release announcing the completion of the required independent valuation, allowing the Company to proceed with the Share Exchange Agreement. Following the press release, all the members of the Board voted to approve the Share Exchange transaction and authorize the execution of the Share Exchange Agreement and ancillary agreements, including this proxy statement to seek stockholder approval.

Effects of the Share Exchange on DSS Common Stock

Each share of our Common Stock that is issued and outstanding at the effective time of the Share Exchange will remain issued and outstanding after the acquisition of Impact BioMedical. However, because additional shares of our Common Stock will be issued as a result of the Share Exchange, the aggregate equity interest of our current common stockholders will be diluted from 100% of our issued and outstanding Common Stock prior to the Share Exchange to approximately 81% of our issued and outstanding Common Stock immediately after the completion of the Share Exchange. Furthermore, any conversion by Global BioMedical of the Series A Preferred Stock for shares of Common Stock, will also have the effect of diluting the equity interest of our current common stockholders. However, as discussed above, any such conversion by Global Biomedical is subject to the Beneficial Ownership Limitation. In the event of any voluntary or involuntary liquidation, dissolution or winding up of the Company, the holders of Shares of Series A Preferred Stock then outstanding will be entitled to be paid out of the assets of the Company available for distribution to its stockholders, before any payment will be made to holders of our Common Stock.

| 7 |

Recommendations of our Board of Directors to our stockholders

Our Board has determined that the acquisition of Impact BioMedical is in the best interests of our stockholders, and recommends that you vote FOR the approval of the issuance of shares of our Common Stock and the Series A Preferred Stock for such purpose and FOR adjournment of the meeting if necessary to solicit additional proxies.

United States federal income tax considerations

The Share Exchange is intended to qualify as a tax-free exchange under Section 351 of the Internal Revenue Code for United States federal income tax purposes. Our current stockholders will not recognize any gain or loss for federal income tax purposes as a result of the Share Exchange. Such tax treatment is not a condition to completion of the Share Exchange.

In the event that the Company issues a dividend to its shareholders of shares of Impact BioMedical (the “Bonus Shares”), the U.S. federal income tax treatment of such issuance of the Bonus Shares to our shareholders is unclear at this stage. Accordingly, stockholders are encouraged to consult their own tax advisors as to the specific U.S. federal, state and local, and non-U.S. tax consequences to them of a possible distribution of the Bonus Shares. For more information, see the section titled “Anticipated Dividend of Impact BioMedical Shares” below.

Regulatory Approvals

We do not believe the Share Exchange to be subject to the reporting and waiting provisions of the Hart-Scott-Rodino Antitrust Improvements Act of 1976 which prevents transactions meeting certain size tests, and not otherwise exempt, from being completed until required information and materials are furnished to the Antitrust Division of the U. S. Department of Justice (“DOJ”) and the Federal Trade Commission (“FTC”) and the related waiting period expires or is terminated early. Accordingly, no filings have been made or are presently contemplated with the DOJ and FTC in relation to the Share Exchange.

Completion of the acquisition of Impact

The closing of the purchase and sale of the Impact Shares contemplated under the Share Exchange Agreement is subject to a number of customary and other conditions, including both the Company and Singapore eDevelopment having obtained approvals from their respective shareholders, Singapore eDevelopment having obtained requisite approval from the Singapore Exchange, and receipt by DSS of audited financial statements of Impact BioMedical, which are included in this proxy statement soliciting the vote of our stockholders.

The Share Exchange Agreement contains customary representations, warranties and covenants of the parties as well as certain indemnification provisions.

Where the law permits, a party to the Share Exchange Agreement could elect to waive one or more conditions required to complete the Share Exchange. We cannot be certain when (or if) the conditions to the Share Exchange will be satisfied or waived or that the Share Exchange will be completed.

If the giverrequired approvals are received at the Special Meeting we anticipate that the Share Exchange will occur shortly following the Special Meeting. However, we cannot assure you when or if the Share Exchange will occur.

Interests of certain persons in the Share Exchange

In considering the recommendation of the Board of Directors of the Company with respect to issuing shares of DSS Common Stock and Series A Preferred Stock pursuant to acquire Impact and the other matters to be acted upon at the Special Meeting, our Stockholders should be aware that our Chairman of the Board has interests in the Share Exchange that may be different from, or in addition to, the interests of DSS stockholders generally.

Mr. Chan is the Chief Executive Officer and largest shareholder of Singapore eDevelopment, as well as the Chairman of the Board and largest shareholder of the Company.

| 8 |

Mr. Chan also beneficially owns shares of DSS Common Stock which have approximately [ ]% of the voting rights of DSS stockholders as of the Record Date of the Special Meeting. Mr. Chan will beneficially own shares of DSS Common Stock equal to [ ] to the total shares of DSS Common Stock to be issued to the owners of Impact BioMedical in the Share Exchange. Upon completion of the Share Exchange, Mr. Chan will beneficially own approximately [ ]% of the total outstanding shares of DSS Common Stock.

Due to the related-party nature of the transaction, the Audit Committee discussed and evaluated Mr. Chan’s financial interest and material facts as Executive Chairman of Singapore eDevelopment, and subsequently approved, and recommended the Board approve, the Share Exchange Agreement and the transactions contemplated thereby.

Anticipated Dividend of Impact BioMedical Shares

The Company’s long-term plans include seeking to take Impact BioMedial public after the share exchange in an initial public offering (“IPO”). Prior to doing so, and in concert with this public offering, the Company anticipates a proposed dividend of Impact BioMedical shares to its shareholders, whereby for every one DSS share of Common Stock held, the shareholder would be entitled to a bonus of four Impact Shares, or as already referenced, the Bonus shares. The planned Bonus shared dividend would be divided into two tranches; the shareholders of record of a date to be determined but prior to initial public offering would be eligible for two shares for every share of DSS which they hold, and a second dividend of an additional two shares of Impact BioMedical if they were the shareholders of record on the second shareholder of record date of the IPO date of Impact BioMedical. The issuance of the Bonus shares would occur after the registration and the IPO of Impact BioMedical’s shares. While this statement represents the current intentions of DSS management and of its Board, there can beno assurance, however, that Impact BioMedical will be taken public and/or that any such Bonus Share distribution will occur.

Costs associated with the Share Exchange

We estimate that fees and expenses related to the Share Exchange, consisting of fees and expenses of our financial advisor, attorneys, and accountants, proxy statement printing and distribution and related charges, Securities and Exchange Commission (the “SEC”) and NYSE Amex filing fees, will total approximately $[____], whether or not the Share Exchange is completed.

Appraisal rights

Holders of our Common Stock will not have appraisal or dissenters’ rights in connection with the acquisition of Impact or the other proposals to be considered at the Special Meeting.

Board of directors and executive officers after the Share Exchange

There will be no change in the Company’s Board of Directors as a result of the completion of the Share Exchange.

Summary of risks associated with the Share Exchange

There are risks and uncertainties that we face in connection with the proposed acquisition of Impact. Among the risks are the following:

| ● | The issuance of our Common Stock in the Share Exchange will reduce the ownership interests and voting power of our current common stockholders. The current owners of Impact BioMedical will acquire, in the aggregate, approximately [_]% of our Common Stock which will be outstanding upon completion of the Share Exchange. Upon completion of the Share Exchange, our Chairman of the Board Chan Heng Fai Ambrose will have beneficial ownership of shares of our Common Stock which will represent approximately [_]% of our Common Stock to be outstanding. | |

| ● | Failure to complete the Share Exchange could negatively impact our stock price. |

| 9 |

These are just some of the risks we face in connection with the proposed Share Exchange. For a more complete discussion of these and other risks related to the acquisition and the combined company; see the section entitled “Certain Risks Associated with the Share Exchange” and “About Impact BioMedical” below.

CERTAIN RISKS ASSOCIATED WITH THE SHARE EXCHANGE

In deciding whether to approve the issuance of Common Stock and Series A Preferred Stock to acquire Impact BioMedical in the Share Exchange and the other proposals related to the Share Exchange transaction, you should carefully consider the following risks. You should also review and consider the various risks and uncertainties related to our business which we have identified and discussed in our Registration Statement on Form S-1 filed with the SEC on May 21, 2020. If any of these risks actually occur, our business, financial condition or results of operations could be seriously harmed. In that event, the market price for our Common Stock could decline and you may lose all or part of your investment.

Risks related to the Share Exchange transaction

You will incur immediate ownership dilution.

In connection with the Share Exchange, the owners of Impact BioMedical will receive shares of our Common Stock which will represent approximately 19% of our Common Stock which will be outstanding upon completion of the Share Exchange. Accordingly, the percentage of ownership which your Common Stock holdings represents prior to the Share Exchange will be diluted due to the issuance of our Common Stock in the Share Exchange. This exchange ratio is not adjustable based on the market price of our Common Stock.

You may not realize a benefit from the Share Exchange commensurate with the ownership dilution you will experience in connection with the Share Exchange.

If DSS does not realize strategic and financial benefits related to the acquisition of Impact BioMedical, DSS stockholders will have experienced dilution of their ownership interests in DSS without receiving any commensurate benefit, or only partial benefits from the Share Exchange.

The market price of our Common Stock following the Share Exchange may decline as a result of the acquisition of Impact BioMedical and its subsidiaries.

The market price of DSS Common Stock may decline as a result of the Share Exchange for a number of reasons if:

| ● | investors react negatively to the prospects of the combined company’s business and prospects after the Share Exchange; | |

| ● | the effect of the Share Exchange on the combined company’s business and prospects is not consistent with the expectations of investors; or | |

| ● | the combined company does not achieve the perceived benefits of the Share Exchange as rapidly or to the extent anticipated by investors. |

Failure to complete the Share Exchange or delays in completing the Share Exchange could negatively impact our stock price, financial condition, future business and operations.

If the Share Exchange is not completed for any reason, we may be subject to a number of material risks, including the following:

| ● | we will not realize the benefits expected from the Share Exchange; | |

| ● | the price of our Common Stock may decline to the extent that the current market price of our Common Stock reflects a market assumption that the Share Exchange will be completed; | |

| ● | if the non-completion of the Share Exchange were due to a breach by DSS of the Share Exchange Agreement we could be responsible for reimbursing the expenses incurred by the Impact BioMedical owners which would further deplete our working capital. |

| 10 |

Compliance with securities laws.

The Common Stock which will be issued in connection with the Share Exchange is being offered without registration under the Securities Act of 1933 pursuant to rules governing limited offers and sales without registration pursuant to the exemption available for sales without registration under Section 4(a)(2) of the Securities Act and Rule 506 of Regulation D. If we should fail to comply with each and every one of the requirements of the available exemptions from registration, the investors may have the right to rescind their acquisition of such shares in connection with the Share Exchange.

The following description of the material information about the Share Exchange, including the summary of the material terms and provisions of the Share Exchange Agreement, is qualified in its entirety by reference to the more detailed appendices to this Proxy provides voting instructionsStatement. We urge you to cast a vote “AGAINST” any orread all of the nominated directorsappendices to this Proxy Statement in their entirety.

The Share Exchange Agreement has been included as Appendix A to provide you with information regarding its terms. It is not intended to provide any other factual information about us. Such information can be found elsewhere in this Proxy Statement and in the other public filings we make with the SEC, which are available without charge at www.sec.gov.

ABOUT IMPACT BIOMEDICAL AND ITS SUBSIDIARIES

Business Overview

Impact BioMedical leverages on its scientific know-how and intellectual property rights to provide solutions that have been plaguing the biomedical field for decades. Together with scientific partners, Impact BioMedical aims to drive mission-oriented research to advance drug discovery and development for the prevention, inhibition, and treatment of neurological, oncology and immuno-related diseases.

Impact BioMedical’s research and development efforts are headed by Mr. Daryl Thompson in his capacity as Director of Scientific Initiatives in Global BioLife Inc. (“Global BioLife”). Mr. Thompson has initiated research regarding universal therapeutics as part of an attempt to help cure some of the world’s deadliest diseases.

Impact BioMedical has two wholly owned subsidiaries and six partially owned subsidiaries. It is the single largest and controlling shareholder of Global BioLife, with an effective ownership of 63.64%. The other shareholders of Global BioLife include Holista CollTech Limited (“Holista CollTech”) (the majority shareholder of Singapore eDevelopment is also a significant shareholder in Holista CollTech) and an entity formed by the chief scientist overseeing Global BioLife’s projects.

Global BioLife has biomedical intellectual property, including intellectual property assigned to it by one of its shareholders. Global BioLife is a company devoted to research in four main areas: (i) the “Linebacker” project, which aims to develop a universal therapeutic drug platform; (ii) a new sugar substitute called “Laetose,”; (iii) a multi-use fragrance called “3F” (Functional Fragrance Formulation); and (iv) Equivir/Nemovir, a blend of natural polyphenols designed as an antimicrobial medication.

Linebacker

“Linebacker,” has demonstrated promising results in treating a range of diseases including neurological, anti-microbial, anti-viral and oncology diseases. Unlike the traditional approach to treat individual diseases with specific drugs, the Linebacker platform seeks to offer a breakthrough therapeutic option for multiple diseases. Linebacker is designed to work by inhibiting a cascade of inflammatory responses responsible for many diseases. Its design is in direct contrast to the traditional approach of targeting individual diseases with specific drugs. Charles River Laboratories International, Inc., an independent company that provides services to help pharmaceutical and biotechnology companies, government agencies and leading academic institutions around the globe, has performed the studies needed for Global BioLife Linebacker research and drug development efforts.

| 11 |

Laetose

Impact BioMedical has also developed a low-calorie, low glycemic level, natural modified sugar through Global BioLife. The product, “Laetose,” is a functional sugar with a calorie count 30% to 50% lower than regular sugar. Laetose is designed to possess low glycemic properties and mitigate inflammation. This product is at the commercialization stage. The company is presently seeking to license Laetose. Global BioLife established a joint venture, Sweet Sense, Inc. (“Sweet Sense”), with Quality Ingredients, LLC for the development, manufacture, and global distribution of the new sugar substitute. On November 8, 2019, the Company purchased 50% of Sweet Sense Inc. from Quality Ingredients, LLC for $91,000. Sweet Sense is now an 81.8% owned subsidiary of the Impact BioMedical.

Functional Fragrance Formulation (“3F”)

Through Global BioLife, Singapore eDevelopment has established a collaboration with U.S.-based Chemia Corporation to develop specialized fragrances to counter mosquito-borne diseases such as Zika and Dengue, among other medical applications. The 3F mosquito fragrance product, which is made from specialized oils sourced from botanicals that mosquitos avoid, has shown promising results in repelling mosquitos in laboratory testing. Global BioLife is seeking to commercialize this product. Together with Chemia, Impact BioMedical is attempting to license 3F. Any potential profits from the 3F project will be split between Global BioLife and Chemia pursuant to the terms of the Royalty Agreement, dated as of August 15, 2018, by and between Global BioLife and Chemia Corporation, and the Addendum thereto, dated as of November 27, 2018 and Amendment No. 1 to Royalty Agreement, dated as of November 8, 2019.

Equivir

Equivir was created for use in biological emergencies. Equivir is a patented medication, and our research has indicated that it has broad antiviral efficacy against multiple types of infectious disease. The ability of Equivir to inhibit viruses makes it a promising candidate.

Global BioLife and Sweet Sense have engaged a consulting firm in the biopharmaceutical and life sciences industry, to assist in our goal of licensing each of Linebacker, Laetose, 3F and Equivir/Nemovir.

Property

Impact BioMedical does not have offices, and at the present time, office space is provided to the Impact BioMedical by an affiliate of Singapore eDevelopment at no cost.

Commercialization Business Strategies

The business model of Impact BioMedical revolves mainly around two approaches – Licensing and Sales Distribution.

1. Licensing

The licensing strategy envisions that Impact BioMedical’s subsidiaries would develop valuable and unique patented technologies which would then be licensed to pharmaceutical companies or venture capitalists in exchange for an agreed payment (consisting of a fee or royalty). Impact BioMedical believes that interest in licensing certain projects may rise over time as validating data becomes available.

| 12 |

2. Sales Distribution

Certain affiliates of Impact BioMedical have relationships with developing global distribution networks. Impact BioMedical currently intends to engage in private labelling to go into production of products for sales generation. Impact BioMedical plans to expand its geographical presence globally and intends to launch more products to add on over time. In addition, the company intends to launch a new retail e-commerce site in 2020 to allow Impact BioMedical to take orders and deliver products.

Employees

Impact BioMedical has no employees; certain services are provided to Impact BioMedical and its subsidiaries by the employees of Impact BioMedical’s ownership, including employees of affiliates of Singapore eDevelopment. Services are provided to Global BioLife and its subsidiaries by GRDG Sciences, LLC pursuant to the Stockholders’ Agreement, dated as of April 26, 2017 among Global BioLife, Global BioMedical, Inc., Holista CollTech and GRDG Sciences, LLC (as amended). At the present time, Global BioLife pays GRDG Sciences, LLC $23,319 per month for services provided by GRDG Sciences, LLC.

Future Product Research Pipeline

In addition to the Impact BioMedical’s major projects, the company has several other early stage research projects that Impact BioMedical believes have potential for further research and development.

Duotics

Duotics is a new class of compounds that has the potential to treat infectious diseases caused by viruses, bacteria, and parasites, and defeat Anti-Microbial Resistance. GRDG has used its proprietary methods in molecular mapping and disease modeling to develop strategies intended to not only inhibit resistant microbes that cause infectious diseases, but to also prevent future resistance to treatment. Duotics harness the strategies used by nature to prevent and inhibit infections by stopping the survival and growth of disease. This project envisions leveraging top research institutions in the world, including Biosafety Level 3 and 4 testing facilities, to scientifically prove the effectiveness of this new class of compounds. If successful, this technology has the potential to integrate well into existing health programs.

Migraine Medical Food

GRDG has developed a technology with the potential to be deployed as a medical food or an Over the Counter (OTC) medication to treat and possibly prevent migraines. Using the proprietary methods of identifying neurological pathways and known remedies, the solution could be both effective, and unlike current migraine medication, free from adverse side effects. GRDG intends to leverage its network of connections with world-class laboratories to formulate, validate and test the medication for effectiveness in animals and humans.

Cannabinoid Research

GRDG intends to work in collaboration with research institutions to enhance a cannabinoid extract for the treatment of cancers and cancer-associated pain. GRDG will look to use the expertise of collaborating research institutions to synthesize, test and validate the compounds. The result of this one-year program will be looking at two therapeutic drugs that have been evaluated for in-vitro efficacy against Pancreatic, Lung, Breast, and Prostate Cancer; in-vivo efficacy against Pancreatic Cancer in an animal model; in-vivo efficacy against Pancreatic Cancer-induced pain in an animal model; and in-vivo Pharmacokinetic and toxicity in animals to include vital organ and blood plasma concentrations after administration, major cytokine activity, renal function, blood chemistry/hematology, cellular morphology, Mitotic index, and Maximum Tolerated Dose. These tests, conducted in rats, will attempt to determine how much of the drugs can be administered safely, the effects of the drugs on metabolism and organs, and their effective doses for the respective purposes.

| 13 |

Competition

The biohealth business is highly competitive. Existing and future competitors may introduce products and services in the same markets we serve, and competing products or services may have better performance, lower prices, better functionality and broader acceptance than our products. This competition could result in increased sales and marketing expenses, thereby materially reducing our operating margins, and could harm our ability to increase, or cause us to lose, market share.

Most, if not all, of our current and potential competitors may have significantly greater resources or better competitive positions in certain product segments, geographic regions or user demographics than we do. These factors may allow our competitors to respond more effectively than us to new or emerging technologies and changes in market conditions.

Impact BioMedical’s competitors may develop products, features or services that are similar to its own or that achieve greater acceptance, may undertake more far-reaching and successful product development efforts or marketing campaigns, or may adopt more aggressive pricing policies. Certain competitors could use strong or dominant positions in one or more markets to gain competitive advantage against Impact BioMedical in its target market or markets. As a result, Impact BioMedical’s competitors may acquire and engage customers or generate revenue at the expense of our own efforts.

Regulation of the Biohealth Business

In the United States, the drug, device and cosmetic industries have long been subject to regulation by various federal and state agencies, primarily as to product safety, efficacy, manufacturing, advertising, labeling and safety reporting. The U.S. Food and Drug Administration, or FDA, has broad regulatory powers. Extensive testing and documentation is required for FDA approval of new drugs and devices, increasing the expense of product introduction. Significant expenses are also evident in major markets outside of the United States.

The costs of human health care have been and continue to be a subject of study, investigation and regulation by governmental agencies and legislative bodies around the world. In the United States, attention has been focused on drug prices and profits and programs that encourage doctors to write prescriptions for particular drugs, or to recommend, use or purchase particular medical devices. The regulatory agencies under whose purview Impact BioMedical may operate in the future have administrative powers that may subject partners to whom Impact BioMedical licenses products to actions such as product withdrawals, recalls, seizure of products and other civil and criminal sanctions.

In addition, business practices in the health care industry have come under increased scrutiny, particularly in the United States, by government agencies and state attorneys general, and resulting investigations and prosecutions carry the risk of significant civil and criminal penalties.

Partners to whom we license products in the future may need to rely on global supply chains, and production and distribution processes, that are complex, subject to increasing regulatory requirements, and may be faced with unexpected changes that may affect sourcing, supply and pricing of materials used in products which we have or will develop. These processes also are subject to lengthy regulatory approvals.

Risk Factors related to Impact BioMedical’s Business Operations

If we do not adequately protect Impact BioMedical’s intellectual property rights, its operations may be materially harmed.

Impact BioMedical relies on and expect to continue to rely on agreements with parties with whom we have relationships, as well as patent, trademark and trade secret protection laws, to protect our intellectual property and proprietary rights. We cannot assure you that we can adequately protect its intellectual property or successfully prosecute potential infringement of its intellectual property rights. Also, we cannot assure you that others will not assert rights in, or ownership of, trademarks and other proprietary rights of Impact BioMedical or that we will be able to successfully resolve these types of conflicts to our satisfaction. Impact BioMedical’s failure to protect its intellectual property rights may result in a loss in potential revenue and could materially harm our operations and financial condition.

| 14 |

New legislation, regulations or rules related to obtaining patents or enforcing patents could significantly increase our operating costs and decrease any potential revenue we might otherwise make.

Impact BioMedical spends a significant amount of resources on its [?] patent assets. If new legislation, regulations or rules are implemented either by Congress, the U.S. Patent and Trademark Office (the “USPTO”) or the courts that impact the patent application process, the patent enforcement process or the rights of patent holders, these changes could negatively affect its expenses, potential revenue and could negatively impact the value of its assets.

Safety and effectiveness concerns can have significant negative impacts on sales and results of operations, lead to litigation and cause reputational damage.

Concerns about product safety, whether raised internally or by litigants, regulators or consumer advocates, and whether or not based on scientific evidence, can result in safety alerts, product recalls, governmental investigations, regulatory action on the part of the FDA (or its counterpart in other countries), private claims and lawsuits, payment of fines and settlements, declining sales and reputational damage. These circumstances can also result in damage to brand image, brand equity and consumer trust in products. Product recalls could in the future prompt government investigations and inspections, the shutdown of manufacturing facilities, continued product shortages and related sales declines, significant remediation costs, reputational damage, possible civil penalties and criminal prosecution.

Significant challenges or delays in our innovation and development of new products, technologies and indications could have an adverse impact on our long-term success.

Impact BioMedical’s continued growth and success depend on our ability to innovate and develop new and differentiated products and services that address the evolving health care needs of patients, providers and consumers. Development of successful products and technologies may also be necessary to offset revenue losses should our products lose market share due to various factors such as competition and loss of patent exclusivity. We cannot be certain when or whether Impact BioMedical will be able to develop, license or otherwise acquire companies, products and technologies, whether particular product candidates will be granted regulatory approval, and, if approved, whether the products will be commercially successful. Impact BioMedical pursues product development through internal research and development as well as through collaborations, acquisitions, joint ventures and licensing or other arrangements with third parties. In all of these contexts, developing new products, particularly biotechnology products, requires a significant commitment of resources over many years. Only a very few biopharmaceutical research and development programs result in commercially viable products. The process depends on many factors, including the ability to discern patients’ and healthcare providers’ future needs; develop new compounds, strategies and technologies; achieve successful clinical trial results; secure effective intellectual property protection; obtain regulatory approvals on a timely basis; and, if and when they reach the market, successfully differentiate its products from competing products and approaches to treatment. New products or enhancements to existing products may not be accepted quickly or significantly in the marketplace for healthcare providers, and there may be uncertainty over third-party reimbursement. Even following initial regulatory approval, the success of a product can be adversely impacted by safety and efficacy findings in larger patient populations, as well as market entry of competitive products.

THE SHARE EXCHANGE AGREEMENT

Share exchange consideration

The Share Exchange Agreement provides that at the closing of the Share Exchange, DBHS will acquire of all of the Impact Shares in exchange for DSS Common Stock and Series A Preferred Stock.

The aggregate consideration for the Impact Shares will be the following to be issued to Global BioMedical by DSS: (i) 483,334 newly issued shares of Common Stock of DSS, nominally valued at $3,132,000, or $6.48 per share; and (ii) 46,868 newly issued shares of a new series of perpetual convertible preferred stock of DSS (“Convertible Preferred Stock”) with a stated value of $46,868,000, or $1,000 per share, for a total consideration valued at $50 million.

| 15 |

The terms of the Share Exchange Agreement and the Share Exchange were previously reported in the Form 8-K filed by the Company on March 13, 2020. As previously reported, on May 7, 2020, following the date of the Share Exchange Agreement we effected a 30-1 reverse stock split. As a result, the number of Common Stock shares to be issued by DSS pursuant to the Share Exchange have been appropriately adjusted.

Closing

The Share Exchange will be completed when the purchase and sale of the Impact Shares occurs at a closing (the “Closing”) to be held not later than two business days after the last of the conditions to the Closing have been satisfied or waived. As a result of the Share Exchange, DBHS will own 100% of Impact BioMedical and its subsidiaries.

Subject to the conditions to the Share Exchange Agreement, we anticipate that the completion of the Share Exchange will occur promptly after the approval of Proposal 1 at the Special Meeting. However, the completion of the Share Exchange could be delayed if there is a delay in satisfying conditions to the Share Exchange. There can be no assurances as to whether, or when, we will obtain the required approvals or complete the Share Exchange. If the Share Exchange is not completed on or before one hundred eight (180) days after April 27, 2020, either we or Global BioMedical may terminate the Share Exchange Agreement, unless the failure to complete the Share Exchange by that date is due to the material breach of the Share Exchange Agreement by the party seeking to terminate the agreement. See “Closing Conditions to the Share Exchange” immediately below.

Closing Conditions to the Share Exchange

The completion of the Share Exchange is subject to various conditions. While we anticipate that all of these conditions will be satisfied, there can be no assurance as to whether or when all of the conditions will be satisfied or, where permissible, waived.

The obligations of each party to effect the Share Exchange are subject to the following conditions:

| ● | The Share Exchange Agreement and the transactions contemplated thereby shall have been approved by the requisite vote of (i) the Board of Directors of each of DSS and DBHS, and (ii) the stockholders of DSS at the Special Meeting; | |

| ● | The Share Exchange Agreement and the transactions contemplated thereby shall have been approved by the requisite vote of (i) the Board of Directors of each of Singapore eDevelopment and Global BioMedical, (ii) the stockholder of the Global BioMedical, and (iii) the stockholders of Singapore eDevelopment at the Singapore eDevelopment Stockholders’ Meeting; | |

| ● | No governmental authority shall have enacted, issued, promulgated, enforced or entered any Order which is in effect and has the effect of making the transactions contemplated by the Share Exchange Agreement illegal, otherwise restraining or prohibiting consummation of such transactions or causing any of the transactions contemplated thereunder to be rescinded following completion thereof; | |

| ● | Global BioMedical and Singapore eDevelopment shall have received all consents authorizations, orders and approvals from certain governmental authorities as set forth in the Share Exchange Agreement, and DBHS and DSS shall have received all consents, authorizations, orders and approvals from the governmental authorities as set forth in the Share Exchange Agreement, in each case, in form and substance reasonably satisfactory to DBHS and Global BioMedical, and no such consent, authorization, order and approval shall have been revoked. | |

| ● | The Certificate of Designations shall have been filed with the Secretary of State of the State of New York. |

| 16 |

For the full text of the closing conditions that each individual party’s obligations are subject to, see the Share Exchange Agreement which has been included as Appendix A to provide you with information regarding its terms.

Representations and warranties

The Share Exchange Agreement customary representations, warranties and covenants of the parties as well as certain indemnification provisions. For the full text of the representations and warranties, see the Share Exchange Agreement which has been included as Appendix A to provide you with information regarding its terms.

Reasonable best efforts to consummate the Share Exchange

Each party to the Share Exchange Agreement has agreed that it will not voluntarily undertake any course of action inconsistent with the provisions or intent of the Share Exchange Agreement and will use its reasonable best efforts to take, or cause to be taken, all action and to do, or cause to be done, all things reasonably necessary to expeditiously satisfy the closing conditions to the Share Exchange Agreement.

No Solicitation or Other Bids

From the date of the Share Exchange Agreement, each party to the Share Exchange Agreement will not authorize or permit any, affiliates and other representatives or those of any of their subsidiaries, directly or indirectly, to (i) encourage, facilitate or continue inquiries; (ii) enter into discussions or negotiations with, or provide any information to; or (iii) enter into any agreements or other instruments (whether or not binding) regarding an inquiry, proposal or offer from any person concerning, (x) a merger, consolidation, liquidation, recapitalization, share exchange or other business combination transaction involving Impact BioMedical or any of its subsidiaries; (y) the proposals,issuance or acquisition of shares of capital stock or other equity securities of Impact BioMedical or any of its subsidiaries; or (z) the Proxy Representative will vote such shares accordingly. If the giversale, lease, exchange or other disposition of any significant portion of the Proxyproperties or assets of Impact BioMedical and its subsidiaries.

Termination of the Share Exchange Agreement

The Share Exchange Agreement may be terminated prior to the closing on certain conditions, including:

| ● | by mutual written consent of DBHS and Global BioMedical; | |

| ● | by either DBHS or Global Medical in the event that such party is not then in material breach of any provision of the Share Exchange Agreement and there has been a breach , inaccuracy in or failure to perform any representation, warranty, covenant or agreement made by the counterparties that would give rise to the failure of the conditions precedent to closing that has not been cured after 10 days written notice to the counterparties; | |

| ● | if certain other conditions as set forth in the Share Exchange Agreement shall not have been, or it becomes apparent that any of such conditions will not be, fulfilled by the date that is 180 days after the date of the Share Exchange Agreement; | |

| ● | in the event that (i) any law makes consummation of the transactions contemplated by Share Exchange Agreement illegal or otherwise prohibited or (ii) a government authority issues an order restraining or enjoining the transactions contemplated by the Share Exchange Agreement, and such order becomes final and non-appealable; | |

| ● | by either DBHS or Global Medical if the stockholders of DSS or Singapore eDevelopment vote on, but fail to approve, the Share Exchange Agreement at each’s respective stockholders’ meeting |

| 17 |

In the event of the termination of the Share Exchange Agreement pursuant to one of the conditions listed above by one of the parties, the Share Exchange Agreement shall become void and have no effect, and there shall be no liability under the Share Exchange Agreement on the part of the parties except (i) in the event of breach of conditions listed above; (ii) in the event of breach by Singapore eDevelopment or Global Medical of confidentiality provisions contained in the Share Exchange Agreement; or (iii) as set forth in ARTICLE X – MISCELLANEOUS of the Share Exchange Agreement which has been included as Appendix A to provide you with information regarding its terms. Nothing in the Share Exchange Agreement shall relieve any party from liability for any willful breach of any provision contained in the Share Exchange Agreement.

Amendment, modification and waiver

The Share Exchange Agreement may only be amended, modified or supplemented by an agreement in writing signed by each party thereto. No waiver by any party of any of the provisions thereof shall be effective unless explicitly set forth in writing and signed by party so waiving. No waiver by any Party shall operate or be construed as a waiver in respect of any failure, breach or default not expressly identified by such written waiver, whether of a similar or different character, and whether occurring before or after that waiver.

No failure to exercise, or delay in exercising, any right, remedy, power or privilege arising from the Share Exchange Agreement shall operate or be construed as a waiver; nor shall any single or partial exercise of any right, remedy, power or privilege thereunder preclude any other or further exercise thereof or the exercise of any other right, remedy, power or privilege.

The foregoing summary of the Share Exchange Agreement is subject to, and qualified in its entirety by, the terms of the Share Exchange Agreement, a copy of which is attached hereto asAppendix A.

SELECTED HISTORICAL AND PRO FORMA FINANCIAL DATA

We are providing the following financial information to assist you in your analysis of the financial aspects of our proposed acquisition of Impact BioMedical and its subsidiaries. This information is only a summary and you should read it in conjunction with our historical consolidated financial statements, and the historical financial statements of Impact BioMedical and the other information included elsewhere in this proxy statement.

Selected Historical Financial Data of Impact BioMedical and its Subsidiaries

The following table sets forth selected historical financial information derived from Impact BioMedical’s audited financial statements as of and for the year ended December 31, 2019 and as of December 31, 2018 and unaudited financial statements for the period from January 1, 2020 through March 31, 2020. The historical results presented below are not necessarily indicative of the results to be expected for any future period.

| 18 |

REPORT OF INDEPENDENT AUDITORS

AND FINANCIAL STATEMENTS

Impact BioMedical Inc and Subsidiaries

December 31, 2019 and 2018

Table of Contents

| 19 |

Impact BioMedical Inc and Subsidiaries

Consolidated Balance Sheets

Impact Biomedical Inc. and Subsidiaries

Consolidated Balance Sheet

| December 31, | December 31, | |||||||

| 2019 | 2018 | |||||||

| Asset | ||||||||

| Cash | $ | 108,731 | $ | 35,375 | ||||

| Prepaid Expense | 30,700 | 22,761 | ||||||

| Investment in Security by Equity Method | 5,312 | |||||||

| Total Asset | $ | 139,431 | $ | 63,448 | ||||

| Liabilities | ||||||||